State Farm Offers Electronic Dance Music Coverage

Contents

State Farm now offers electronic dance music coverage for your events. Check out our website for more information.

Introduction

State Farm has announced a new insurance policy that is specifically designed for electronic dance music (EDM) events. The policy includes coverage for cancellations, weather-related event delays, and other issues that can arise during the planning and execution of an EDM event.

This policy is a response to the growing popularity of EDM events, which have become increasingly popular in recent years. According to State Farm, the number of EDM events held in the United States has tripled since 2010.

“Our research shows that the popularity of electronic dance music is only going to continue to grow,” said State Farm spokesperson Phil supple in a statement. “We want to be able to provide our customers with the coverage they need to put on a successful event.”

The new policy is available for purchase starting today. For more information, visit State Farm’s website or speak with your local agent.

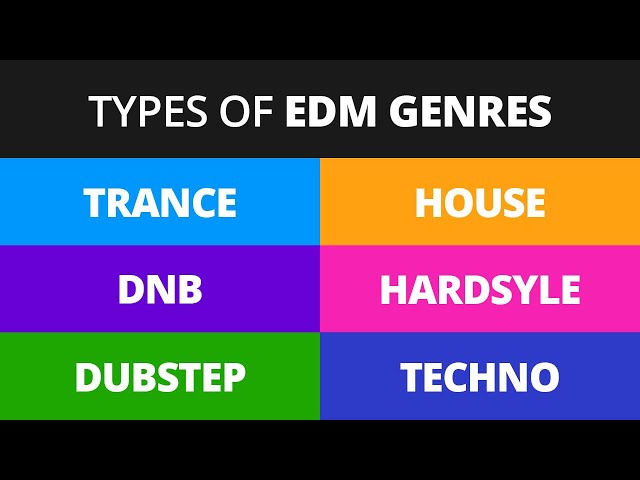

What is Electronic Dance Music?

Electronic Dance Music, or EDM for short, is a genre of music that emerged in the early 1990s. It is characterized by a heavy 4/4 beat and often uses synthesizers and drum machines. EDM is often played at nightclubs, festivals, and concerts.

What Does State Farm’s Coverage Include?

State Farm’s new electronic dance music insurance policy will protect event promoters, performers, and production companies against potential losses due to cancellations, weather, and more. The policy, which is underwritten by Fireman’s Fund Insurance Company, will be available in all 50 states.

As the popularity of electronic dance music (EDM) events has grown in recent years, so has the need for specialized insurance coverage. State Farm’s new policy is designed to meet the unique needs of the EDM industry, offering protection for cancellations, bad weather, non-appearance of headliners, and more.

“We are excited to offer this new coverage to help protect promoters, performers, and production companies who are bringing this exciting form of entertainment to fans around the country,” said State Farm spokesperson Justin Glover. “This policy is just one more way we are meeting the evolving needs of our customers.”

For more information about State Farm’s electronic dance music insurance coverage, please visit www.statefarm.com/EDMinsurance.

How Much Does the Coverage Cost?

The cost of the coverage will vary depending on the value of your musical equipment and the extent of the coverage that you choose. However, State Farm offers a variety of affordable options to meet your needs.

How to Get the Coverage

State Farm is now offering insurance coverage for electronic dance music events. The insurance will protect promoters, venues, and artists from losses due to cancellation or postponement of the event.

To get the coverage, event organizers will need to purchase a special Event Cancellation policy from State Farm. The policy will cover losses due to cancellation or postponement of the event, as well as loss of ticket sales and expenses incurred to reschedule the event.

State Farm’s Event Cancellation policy is available to events with up to $5 million in gross receipts. Coverage is provided on a per-event basis, and events must be held in the United States or Canada to be eligible.

Conclusion

State Farm offers electronic dance music coverage to protect your investment in case of accidents or natural disasters. This coverage is available for an additional fee and is subject to the same deductibles as your other policies.